C-Trader Professional™ is a professional-grade trading system development and backtesting platform. It is designed: (1) to work with entire portfolios of stocks, futures, options, and spot forex; (2) to enable testing on any timeframe (e.g., one can easily test systems on 1-second bars); (3) to handle very large data sets (e.g., the entire NYSE going back 15 years); and (4), to enable complex systems that contain both longitudinal and cross-sectional rules to be easily tested and optimized. C-Trader Pro provides a level of power, flexibility, and robustness difficult to find elsewhere. It is appropriate for use by CTAs, hedge funds and professional traders.

The original C-Trader was released in 2000 as companion software to the now-classic book, The Encyclopedia of Trading Strategies (Jeffrey Owen Katz, Ph.D., and Donna L. McCormick; McGraw-Hill). While the software package still contains everything required to replicate and expand the research presented in the book, it has undergone substantial evolution since its first release. Because the enhancements are quite extensive, it is now called C-Trader Professional. As the only trading system development platform used by Dr. Katz, the software is under constant development; bugs are aggressively sought and fixed, and new capabilitities frequently implemented.

C-Trader Professional is reasonably priced and does not require any commitment to expensive brokerage or data services. There are no hidden fees or monthly charges, and no additional cost for live technical support—the developer himself is a just an email or phone call away.

C-Trader Professional is designed to run on Unix and Unix variants (e.g., Solaris, BSD, Linux, Mac OSx). It can be run under Windows with Cygwin, an emulator that provides a Unix-like toolset and environment, some Posix compliance, and an X-Windows interface.

TradeStation™ Users Should Know...

Many TradeStation

users have indicated that C-Trader is more effective for system development

and testing than TradeStation. Among other things, C-Trader is far faster

and more robust than TradeStation and can easily accommodate cross-sectional

as well as longitudinal trading rules. Therefore, many TradeStation users

opt to develop their systems using C-Trader and then port them over to

TradeStation for real-time trading.

Warp Speed

Speed matters when optimizing multiple systems on

very large data sets. C-Trader Pro is extremely fast: anywhere from 20 to

well over 100 times faster than TradeStation when running on a single core.

And, unlike TradeStation, multiple instances of C-Trader can execute

simultaneously under script control enabling you to take full advantage of

cluster computing and multi-core processors! C-Trader running on a small

Linux cluster of multi-core processors can achieve mind-bending terraflop

throughput when optimizing multiple systems on a modest portfolio of

securities. Try that with TradeStation.

Easy to Use

If you have a working knowledge of the C

programming language and can read and understand the code in The

Encyclopedia of Trading Strategies, then you'll find C-Trader Pro very

logical and a pleasure to work with. The software even includes a

searchable online manual!

Readily Extended

The software is designed to be highly modular

and easily extended. By leveraging the standard Unix toolchain and other

freely available software, coupled with the excellent interprocess

communication mechanisms available in Posix-compliant operating systems, new

capabilities are fairly painless to implement. One can even execute, control,

and exchange data with other programs directly from the C-Trader command

prompt or from within C-Trader scripts!

All Trading Vehicles

You can develop and optimize systems for

entire portfolios of options and derivatives, as well as for stocks,

futures, and spot forex, on any timeframe from seconds to years. Even

models that must select trading vehicles on the fly, such as those that

dynamically choose which options on a given underlying to employ at any

instance, can be implemented and tested with ease. Want to backtest a

Gamma-scalping model that involves multiple stock and option positions that

have to be repeatedly rebalanced and otherwise modified? No problem with

C-Trader Professional; one can even make use of synthetic or modeled prices

in simulated derivatives trades! Multiple systems can be tested together as

system portfolios. Overlapping trades, scaling into and out of positions,

and multiple entries and exits are also fully supported.

Built-In Scripting

The software includes a scripting language

that is used for giving commands and for automating optimization and testing

protocols. The commands allow you to easily load data, examine performance

summaries and equity curves, run optimizations, generate graphics, even

execute operating system commands and other programs, all from within

C-Trader Pro!

Extended Performance Summaries

Performance summaries can now

be obtained in basic or extended forms. The performance summaries display

several variations on the Sharpe ratio, drawdown, net equity, average

dollars per trade, number of trades, largest win, largest loss, average win,

average loss, wins, losses, correlation of equity with a straight line,

correlations between in-sample and out-of-sample performance over variations

in system parameters, and a host of other useful statistics, some quite

unique and simply not available elsewhere. The extended reports even display

performance as a function of day-of-month, days-until-expiration, and

day-of-week. When it makes sense to do so, all performance statistics are

provided for both in-sample and out-of-sample periods.

Better Online Reports

Thanks to the pager, searching, and

sorting utilities found on Posix-compliant systems (Unix and Unix variants

like Linux), extended summaries and other reports may be viewed, scrolled,

and searched without disrupting your workflow; likewise, optimization

reports may be sorted according to various criteria, scrolled, and saved to

files for future reference. All of this can be done directly from within

C-Trader Professional without needing to manually open files in other

software applications or text editors—it is all clean and seamless, as well

as extremely fast.

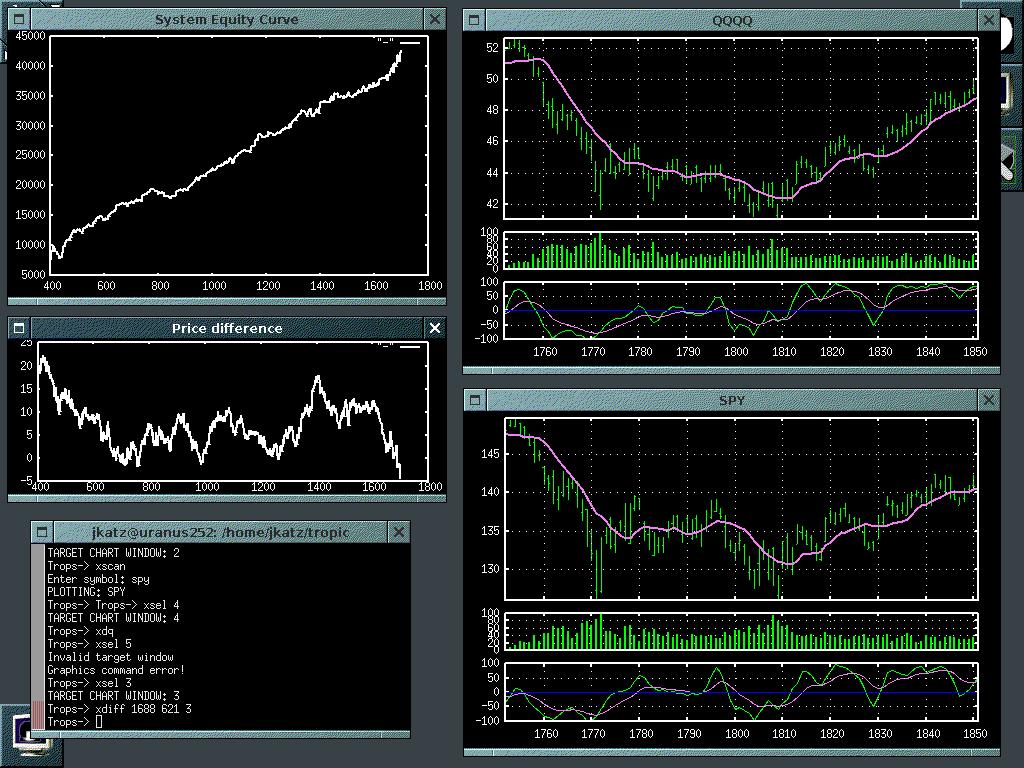

Graphics Capability

C-Trader Professional includes a newly

developed module for generating various kinds of charts using Gnuplot. The

scripting language now provides commands that allow you to display a variety

of high-resolution charts. These charts may even be saved as JPEGs (or in

other formats) for publication, printing, or future reference. In addition,

the software features a scan mode with single keystroke commands that

enables you to easily scan through and examine charts for hundreds, or even

thousands, of securities. All code is supplied as source and may easily be

extended to provide additional charting capabilities. This code is under

active development.

Greater Trading Model Flexibility

The new C-Trader

Professional makes it feasible to backtest systems that trade individual

series, as well as those that trade multiple series, e.g., multiple

derivatives on a single underlying with said derivatives changing from trade

to trade on the basis of the trading rules. Such multiple-series situations

occur, for example, when trading delta-neutral hedges, engaging in gamma

scalping, exploiting skew in options or distortions between different

expirations in futures, and in other similar contexts. Even systems that

trade different stocks, futures, or currencies, depending on comparisons

amongst them, can readily be implemented in C-Trader Pro. To provide these

new capabilities, the software uses a simulation model and an architecture

for defining trades that differs significantly from the original C-Trader

and from other available platforms. If your model only requires trading in

one series at a time, C-Trader Pro provides a translation layer that allows

you to write your system in a simpler TradeStation-like style closer to that

used by the original C-Trader.

Ability to Implement Complex Trading Rules

Trading systems can

make use of both longitudinal and cross-sectional rules in all contexts. For

example, if you want to implement a pairs trading strategy or an option

hedging model, this is the software you need. Trading rules can involve

comparisons over time (i.e., previous bars) and across tradables (i.e.,

different futures, stocks, or options), and these rules can place trades

selectively on different tradables (e.g., options of different strikes and

expirations on a given underlying). It is even possible to have a trading

model that sells one option short while buying another, the particular

options depending dynamically on volatility characteristics, and to have the

backtest treat such combined positions as unitary trades!

Database Management Tools

The package now comes with a variety

of database management tools. Among these are a Yahoo downloader that can

quickly and automatically retrieve end-of-day stock data from Yahoo and

place it into standard comma-delimited files. Similar utilities for handling

data from Pinnacle (end-of-day futures) and from Worden Brothers (end-of-day

stocks) are included. With the aid of some third-party software that

downloads data from Interactive Brokers into shareable comma-delimited files

on a real-time basis, C-Trader Pro can even generate live trading signals

and charts! The same software can be used to download historical data from

Interactive Brokers on timeframes all the way down to 1-second bars for use

in system development. Several utilities to store data from comma-delimited

files into the software's native high-speed binary database formats are also

provided; among these is a program to save raw options data from

Stricknet.com in the highly compressed binary file format used by C-Trader

Professional for managing options data. This latter program is so efficient

that data for every equity option (well over 100,000 per day) on every stock

(several thousand) in the Stricknet data set going back several years can be

saved in a fast-reading file that is well under 1 gigabyte in size! Like

C-Trader Professional itself, all data management tools have the ability to

handle extremely large data sets efficiently. These programs all contain

detailed internal documentation and are easily modified to handle other

input data formats so that they can be customized to work with your favorite

data sources. NEW!!! You can now even use data from TradeStation to

build models in C-Trader!

Live Charts and Trading Signals

C-Trader Professional will

soon include a component with the ability to generate real-time charts and

trading signals for live trading on any desired timeframe. All you need is a

good third-party "data daemon" that can run your data feed into

sharable files. For users of Interactive Brokers we can recommend jTWSdump and jTWSdata . These Java

utilities can download historical data as well as maintain the necessary

"live" files for those who use Interactive Brokers TWS as their trading

platform. C-Trader Pro and jTWSdata make an unbeatable combination for

high-speed scalping and day-trading.

Trading Systems Included as Examples

The software comes with

examples that illustrate how trading systems are implemented and tested in

C-Trader Professional. You can run these examples, optimize them, and modify

them to get a feel for developing your own strategies using this platform.

Among the examples are a simple moving average system and a simple

delta-neutral hedging strategy with simulated Black-Scholes option

prices.

Hardware

The software will compile and run on all Intel-type

hardware (AMD, Cyrix, Intel) with at least 256 MB memory and a few gigabytes

of disk space. Disk and memory requirements beyond the minimum depend on

your data.

Once you order, you will be provided with a password that will enable you to immediately download the software and sample data from our ftp server.

Scientific Consultant Services, Inc.

20 Stagecoach Road,

Selden, New York 11784

Tel: 631-696-3333

Email: Jeffrey Owen Katz, Ph.D., President

Email: Donna

L. McCormick, VP